We created a functional prototype and project for a new tool for managing contracts. It not only arranges insurance, but also administers contracts, collective insurance, and leasing insurance.

ČSOB Pojišťovna – industrial risk insurance

ČSOB Pojišťovna a.s.

6/2020 – 11/2020

Goals

Based on successful references and design sprints within the ČSOB Group, we were asked to design an online system for managing industrial risk insurance. It was necessary to clarify the requirements and needs of the customer and, based on these, evaluate the current solution, and possibly design a new functional prototype.

The aim of the project was to fulfill the need for a system of arranging and convenient administration for

- industrial risk insurance,

- vehicle fleet insurance,

- leasing and collective insurance.

How did we do it?

At the beginning, we needed to clarify and confirm the project objectives, verify the client’s needs, and compare the system requirements. We held a workshop to present our methodology and verify the needs of the client.

Workshops

We studied the necessary documentation, produced some visuals, and visited the headquarters of ČSOB Pojišťovna in Pardubice for the introductory workshop. There were about 15 participants in the workshop.

For the last several years, we have been using iterative methodologies based on SCRAM or KANBAN, and so we have chosen these for this project.

Analysis and consulting

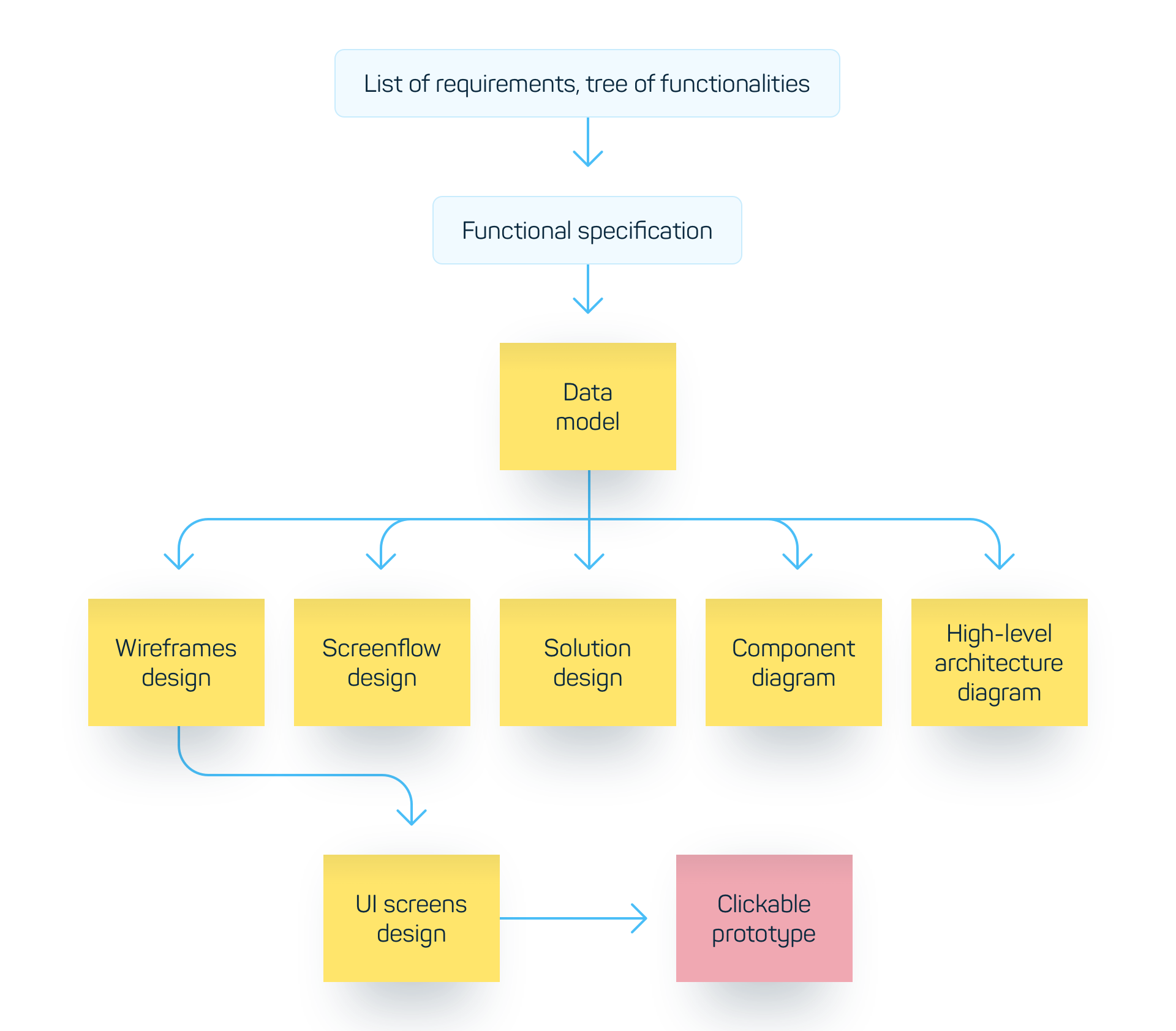

Once we confirmed the way of working and studied all the available documentation, we started to clarify the final scope. There were many requirements, as can be seen below, so we chose a simple and structured way to record the final functionalities of the system with a so-called functionality tree. After 3 weeks and several workshops, we had a clearly defined and demarcated scope , and we had to work on the specifications of integrated systems and overall architecture.

Because we also needed a definition of the data model up to the attribute level to define the system, we started concurrently modeling data flows and resources when defining the architecture.

During the mapping of systems that needed to be integrated into the entire solution, we were also forced to change the scope of the entire system. Our selected iterative methodology paid off in this respect. We constantly tweaked the system target form in terms of the definitions of functionalities, architecture, interface, and data flow, and the final definition of the system gradually began to take shape.

Intensive cooperation was required on the part of the client’s employees, and many functionalities and requests needed to be verified and discussed, so that the final product would satisfy the final intention and fit into the established procedures and processes at ČSOB Pojišťovna, and be in line with a large base of future users. The client provided us with excellent cooperation throughout the project.

Design

Once we had the main scope covered, UX specialists joined and, together with consultants, devised the application workflow, navigation, display methods, and components that would make up the system. Everything had to correspond to the latest UX trends and be suitable for responsive displays of large amounts of data in terms of structure, diverseness, and quantity. Gradually, wireframes (wired model) were created for the main functions, and after these were discussed and approved by the client, the less important functionalities were completed.

As the wireframes gradually emerged, it became apparent that we had chosen the right methodological procedure, confirming the advantage of iterative cooperation.

Once we had created and verified the accuracy of the wireframe model, we adapted the entire prototype of the application to the graphic manual of ČSOB Pojišťovna and created a clickable prototype.

Continuous handover and acceptance

As mentioned above, the emerging definition of the system was continuously verified with a group of stakeholders and user representatives, but still it was necessary to formally approve and, mainly, verify that the system is according to their ideas and will be a meaningful aid in fulfilling a busy work agenda with an expansive base of future users.

What challenges did we see?

- The definition of the client’s needs was formed and carefully specified continuously throughout the project, which had an impact on the scope of the project.

- The specifications of future integrated systems arose during the project, which significantly affected the scope of the project.

- Creating a modern tool with simple navigation for a conservative industry such as insurance.

What we delivered

- Functionality tree

- Data model

- List of componentsv

- Participation in the design of architecture and solution

- Flow diagram

- Wireframe model

- Color clickable prototype of the future system

The main functionalities of the system

- Dashboard with the current agenda for each user

- Business case management

- Bid management

- Client Scoring view/li>

- Insurance risk assessment

- Management of documents related to the agenda

- Modeling of insurance tariffing on varied insurance items

- Management of aggregate limits

- Display and modeling of variant offers

- Subscription management

- Contract management and their extension

- Report display management

- Notifications and messaging

- Co-insurance and reinsurance management

- People management/li>

- Records of correspondence

Benefits

- Responsive and modern system

- Transparent overview of insurance parameters

- Easier approval

- Automated processes

- All in one system